India’s FDI inflows rise, but still behind China, US

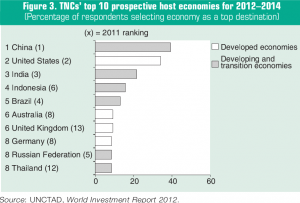

But, China still remained the most-favourite destination for foreign investment. Other South-East Asian economies such as Indonesia and Thailand have risen markedly too to attract investment, the report from UNCTAD (United Nations Conference on Trade and Development) further found.

FDI inflows to China reached a record level of $124bn.

The nature of investment in China also changed with investment in the service sector surpassing investment in the manufacturing sector for the first time.

More like this

However, India has contributed in boosting the Foreign Direct Investment (FDI) inflows in South Asia in 2011.

After a slide in 2009-2010, foreign investment in South Asia is increasing with India accounting for more than four fifths of the region’s FDI, the report showed. FDI inflows in the region reached $39bn (approx. £25bn).

Political risks and obstacles to FDI in South Asia are some of the hurdles for more inflows. These challenges must be tackled in order to build an attractive investment climate, the report warned.

However, recent developments such as the improving relationship between India and Pakistan have highlighted new opportunities.

According to the report, FDI from developed economies (European Union (EU), North America and Japan) rose sharply by 25% to reach $1.24 trillion.

In contrast, flows to Africa continued their downward trend for a third consecutive year, but the decline was marginal, the report further stated.

India’s FDI outflows also rose 12% to reach $15bn. India remained the largest investor in LDCs (least developing countries), followed by China and South Africa.

Most read

- 2015: Full list of Indian States, capitals and their Chief Ministers

- Indian cabinet 2014: Full list of Ministers and their portfolios in the Modi government

- South Indian actress Trisha Krishnan’s father passes away

- Recipe: Misal Pav – how to make missal masala, usal and tarri

- Bollywood hearthrob Shah Rukh Khan is in London attending Asian Awards

- Review: Southall Travel (Also Travel Trolley and Fly Sharp)

- Pics: Amitabh and Aishwarya Rai Bachchan dazzle in Chennai for Kalyan Jewellers

- Mahatma Gandhi statue erected in London’s Parliament Square

- Pics: Trisha Krishnan rocks Tarun Tahiliani saree for Lion film’s audio launch in Hyderabad

- Commonwealth Games 2014: Full list of Indian gold, silver and bronze medal winners

India News Bulletin by email

Desi Events

Featured Stories

More Lead Stories

- Review: Southall Travel (Also Travel Trolley and Fly Sharp)

- Pics: Amitabh and Aishwarya Rai Bachchan dazzle in Chennai for Kalyan Jewellers

- Amitabh Bachchan honoured with Padma Vibhushan

- Long stay Indian visitors, students, professionals to pay for NHS access

- Mahatma Gandhi statue erected in London’s Parliament Square